EU companies top US and Chinese counterparts in R&D investment growth, reversing a decade-long trend

For more than 2 decades now, the EU Industrial Research & Development (R&D) Investment Scoreboard of the European Commission's JRC, has analysed and monitored industrial R&D trends and 'hot' topics, against the backdrop of the EU's R&D investment policy target of 3% of GDP. The target has long been a key performance indicator of the EU's long-term competitiveness: and due to its increased relevance, the topic is gaining back traction.

The much-awaited September 2024 Mario Draghi's report The Future of European Competitivenessonly gave further urgency to the relationship between skills and investment and R&D and Innovation, indicating that the EU has to raise R&D spending to 750-800 billion EUR annually if it wants to be on the same level-playing field as the United States and China and remain competitive to other large global players.

EU competitiveness inextricably tied to digital skills

The 3% target for R&D investment with commitments related to inclusivity and transparency are central to the ability of the European continent to remain competitive in the face of an intensifying global race for technology domination.

Draghi's report looks back into EU-wide policies that have influenced overall progress towards the target:

“Failure to meet the 3% target for R&D expenditure set by EU leaders over two decades ago is a fundamental reason why the EU lags behind the US and China."

Closing the gap in innovation = closing the skills gap?

Closing the digital skills gap then becomes akin to closing what Draghi calls 'the innovation gap', i.e. the space that opens up when inadequate skills supply and demand stemming from low education and training attainment levels meets

The Innovation strategy for Europe also recognises the power of fostering skills and the capacity of the labour force to drive forward new ideas with the potential to influence future adverse events - of environmental, geopolitical, or health nature.

Yet, challenges remain, and these increasingly point to the gaps Draghi's report mentions: if the EU lacks an appropriate skills base, it will lag behind on a global scale even if investment in the development of specific technologies like AI, machine learning and big data is boosted.

Unprecedented decline in education and training attainment levels in Europe fail to get the workforce ready for the next big tech wave

The undersupply of skills in Europe owes to declines in education and training systems that are failing to prepare the workforce for technological change. This is leading to bottlenecks in key industrial sectors like healthcare and manufacturing and directly hampers European competitiveness.

The latest Eurobarometer equally acknowledges that SMEs skills shortages are the top-ranking problem for SMEs throughout Europe. This poses questions as to whether EU education and training systems can address adequately the realities of the labour market today, especially in light of lightning-fast developments in areas like AI and machine learning.

Tracking skills' development in children and adults: illustrating the need for urgent policy action to address low scores in key benchmark surveys

Educational attainment in the EU – as measured by the OECD’s latest PISA scores – is falling. PISA is the OECD's Programme for International Student Assessment, which each year measures 15-year-olds’ reading, mathematics and science knowledge and skills preparedness' for real-life challenges. Logically, this means a large % of adults lack the skills they need to thrive in an increasingly-digital world. The 2023 Survey of Adult Skills, which came out in December 2024, part of the OECD Programme for the International Assessment of Adult Competencies (PIAAC), found that 18% of adults across the 33 participating countries lacked even the most basic levels of proficiency in all tracked domains (literacy, numeracy, digital competence, adaptability and soft skills, etc.).

Programme for International Student Assessment, which each year measures 15-year-olds’ reading, mathematics and science knowledge and skills preparedness' for real-life challenges. Logically, this means a large % of adults lack the skills they need to thrive in an increasingly-digital world. The 2023 Survey of Adult Skills, which came out in December 2024, part of the OECD Programme for the International Assessment of Adult Competencies (PIAAC), found that 18% of adults across the 33 participating countries lacked even the most basic levels of proficiency in all tracked domains (literacy, numeracy, digital competence, adaptability and soft skills, etc.).

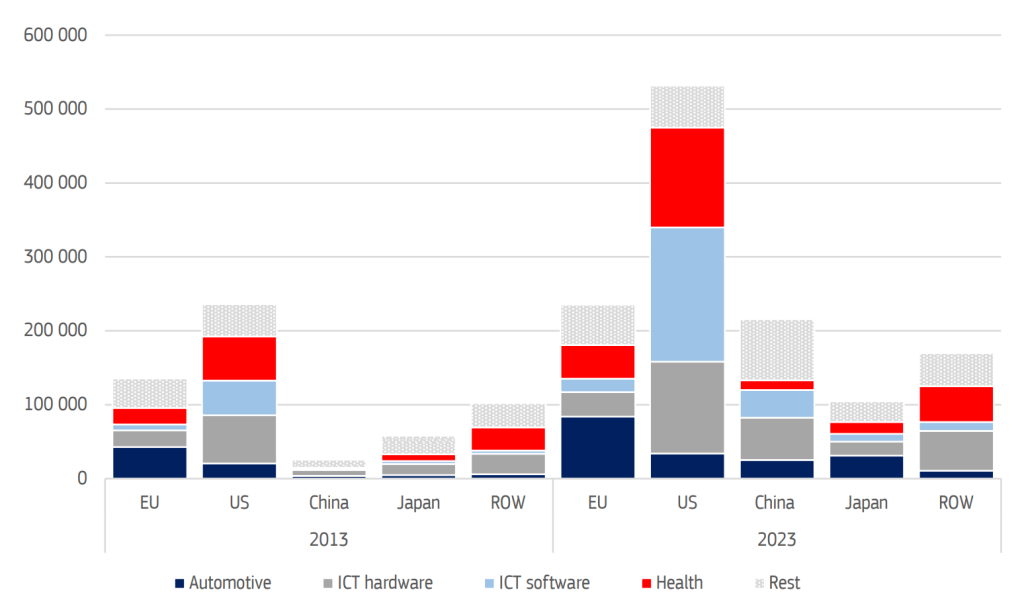

Translating boosted economy growth into concrete benefits for society

According to the IMF's 2024 World Economic Outlook, there is light at the end of the tunnel, with global growth expected to stabilise at around 3.2% for 2024 and 2025. European economy indeed seems to be resuming its growth with a stable pace of just under 1%. But the 2024 EU Industrial Scoreboard points to a worrying trend: on aggregate, global innovation gaps remain. The figure below shows investment in R&D and innovation sees European sectors lagging behind their larger counterparts, despite huge advances in sectors like manufacturing and ICT that make up a major part of overall investment rates.

Taking a closer look at Europe: highlights and figures from the 2024 EU Industrial Scoreboard

The 2024 Scoreboard’s monitors the world's top 2.000 R&D investors, responsible for over three quarters of R&D performed by the business sector globally. In the EU, the Scoreboard counts 322 companies that belong the global 'top core group'. If we zoom in and look closer at the EU, there are around 800 companies headquartered in the EU, who are responsible for the highest R&D investment and boost overall performance.

R&D investment by the 322 Scoreboard companies with headquarter in the EU grew by 9.8%, outpacing the 681 US companies (5.9%) for the second year in a row, and, for the first time, just ahead of the 524 Chinese companies (9.6%).

The EU Top 800 Companies

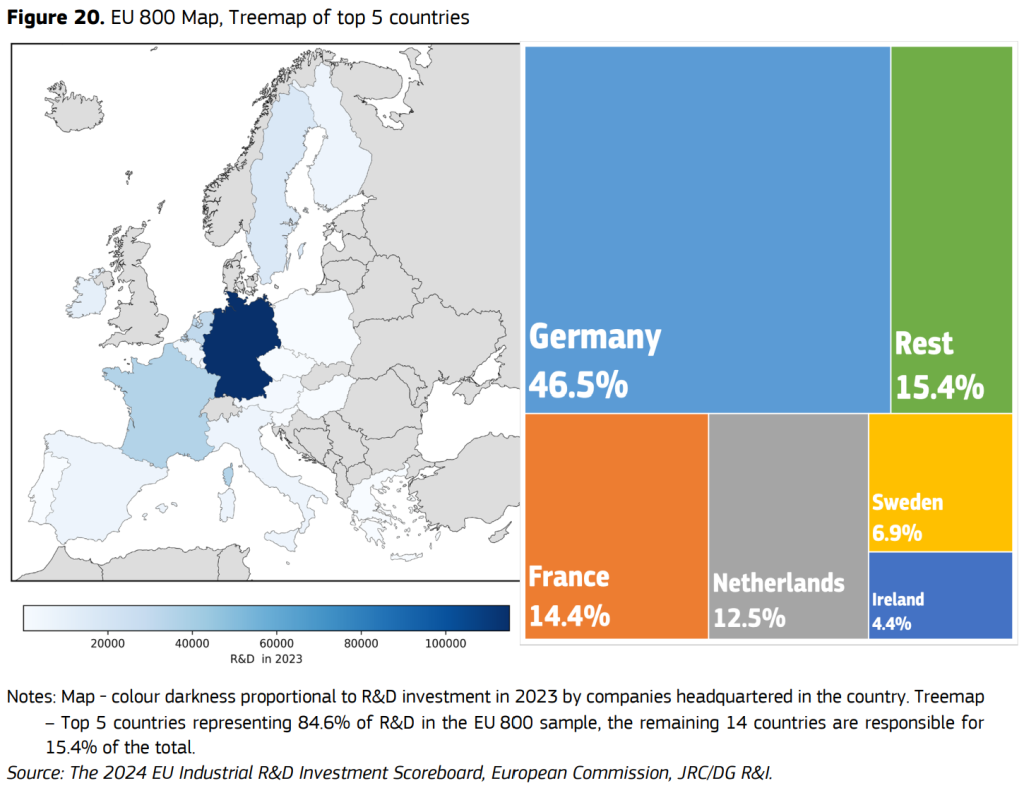

The EU top 800 companies are located in 19 Member States and invested EUR 247.7 billion in R&D in 2023. The map below, taken from the 2024 Industrial Scoreboard, shows the countries where the companies with the highest R&D investment are based.

From the EU top 800, the automotive sector accounts for the largest share of investment in R&D (over 30%). The health sector follows suit with just under 20%, after which come ICT producers (14%), and ICT services with close to 8%. On the other hand, sectors like construction, chemicals and energy are experiencing more of a decline. Comparing the EU top 800 to the global top 2.000, the automotive, aerospace & defence, chemicals, energy, financial and industrials sectors have higher R&D shares in the EU 800, while ICT services, ICT producers and health have in some cases considerably lower shares.

About the 2024 EU Industrial Scoreboard

In 2023, the world’s top 2.000 R&D investors, headquartered across 40 countries and representing over 900.000 subsidiaries, collectively invested EUR 1.257 billion in R&D. This accounted for over 85% of global business-funded R&D. The top 50 companies alone contributed 40% of the total, indicating that a small number of companies control a significant portion of global business sector R&D investment.

Another goal of the EU Industrial R&D Investment Scoreboard is to act as a monitoring tool and a benchmark of the performance of the EU's leading industrial R&D against their global peers - and the tool has successfully performed this function since 2004, acting as an authoritative source for insights and data used by companies, researchers and policymakers across sectors.