Blockchain and the road ahead (deep-dive)

Blockchain technology is rapidly establishing itself as a cornerstone for secure, transparent, and efficient digital transactions across the European Union. By harnessing decentralised ledgers and advanced cryptographic methods, blockchain reduces dependence on intermediaries, strengthens data integrity, and helps build trust in both public and private sector operations. Its influence is evident in areas like supply chain management, digital identity frameworks, and financial services, where immutable records and automated processes are put to work, transforming traditional practices.

The financial sector, in particular, is experiencing a deeper, more profound change as blockchain facilitates instant trade settlements, increases transparency in asset management, and underpins innovative Decentralised Finance (DeFi) models that operate independently of conventional market structures. In banking, blockchain is streamlining cross-border payments by cutting settlement times and costs, while smart contracts automate tasks such as loan disbursement and compliance, reducing errors and operational overhead. Government applications are also expanding, with blockchain technology being used to enhance transparency, accountability, and efficiency in areas ranging from public procurement to digital voting and land registries.

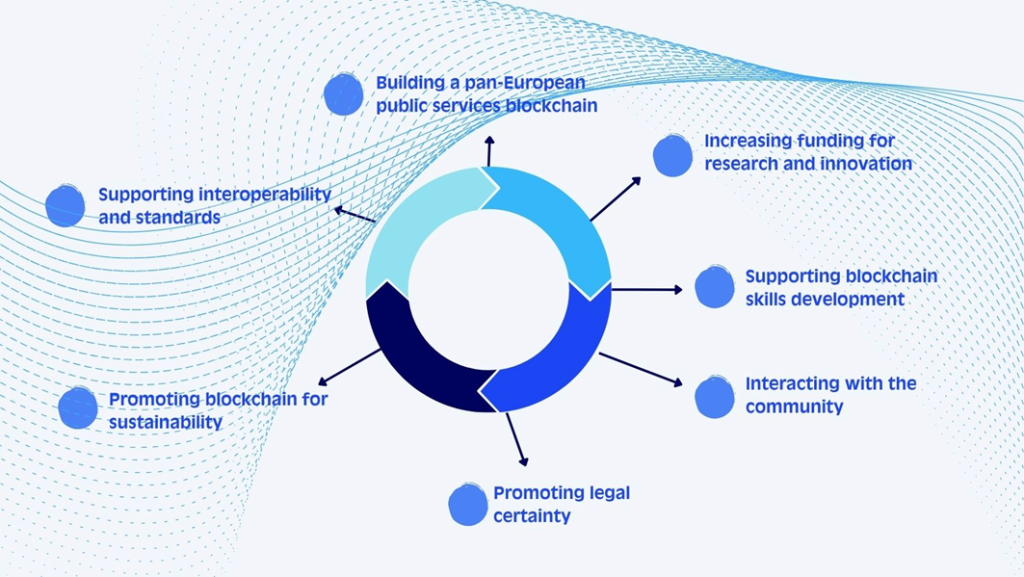

Within this evolving landscape, the European Union is providing legal clarity and fostering innovation by supporting research, best practices, and regulatory frameworks. The EU’s approach includes promoting sustainable blockchain solutions, encouraging interoperability, and ensuring compliance with data protection standards.

Despite its significant promise, blockchain adoption faces challenges related to scalability, energy consumption, and regulatory alignment. The EU is actively addressing these issues by supporting greener consensus mechanisms, investing in research, and developing regulatory sandboxes to accelerate digital transformation. With sustained investment and a clear policy direction, blockchain is poised to play a pivotal role in Europe’s digital and green transitions, offering a realistic, yet invariably optimistic outlook for more secure and efficient digital ecosystems.

Blockchain: arriving at a common understanding

What is blockchain?

Imagine a notebook that everyone can see and write in, but no one can erase or secretly change. Such is the basic idea behind blockchain (a decentralised, secure digital ledger that records transactions and information across a network of computers, rather than being stored in a single place). Each page in this notebook is called a “block”, and as new transactions happen, they are grouped together, verified by the network, and added as a new block, forming a continuous “chain”of blocks (hence the name blockchain).

But what makes blockchain truly special is its transparency. Every participant in the network has a copy of the entire ledger, and each new block is linked to the previous one using a unique digital fingerprint (called a “hash”). This means that once information is added, it cannot be altered or deleted without everyone up and down the chain noticing, making the system highly resistant to fraud and tampering.

Although data on the blockchain is by default visible, it is common to use robust encryption methods to protect sensitive information. These techniques keep data private while maintaining the integrity of the record. The result: a system that is both transparent and secure. Several EU initiatives underline its promise for secure digital services. In this sense, the European Commission’s Digital Services Act (DSA) already introduces new obligations for those digital platforms using blockchain, thus increasing transparency, user protection, and accountability in online services.

Blockchain technology first emerged as the backbone of cryptocurrencies like Bitcoin, enabling secure digital transactions without the need for a central authority. However, its uses now extend to areas such as supply chain tracking (recording every step of a product’s journey from origin to consumer to ensure transparency and quick traceability), healthcare data management (maintaining immutable, patient-controlled health records accessible across providers while protecting privacy), manufacturing (tracking raw materials and production processes to guarantee authenticity and quality), and even secure digital voting (recording votes preserving voters anonymity and ensuring auditability). The European Union’s European Blockchain Services Infrastructure (EBSI) is developing blockchain-based solutions for digital identity and public records, highlighting its versatility beyond cryptocurrencies.

Why does blockchain matter for the future? Because it offers a new way to build trust in digital transactions and systems, reducing reliance on central authorities and making data tamper-proof. This article focuses on the significant impact that blockchain is expected to have on financial management, banking and, perhaps less obviously, government processes. Before exploring these specific areas, it is helpful to first understand how blockchain works in straightforward, non-technical terms.

How blockchain works: a non-technical overview

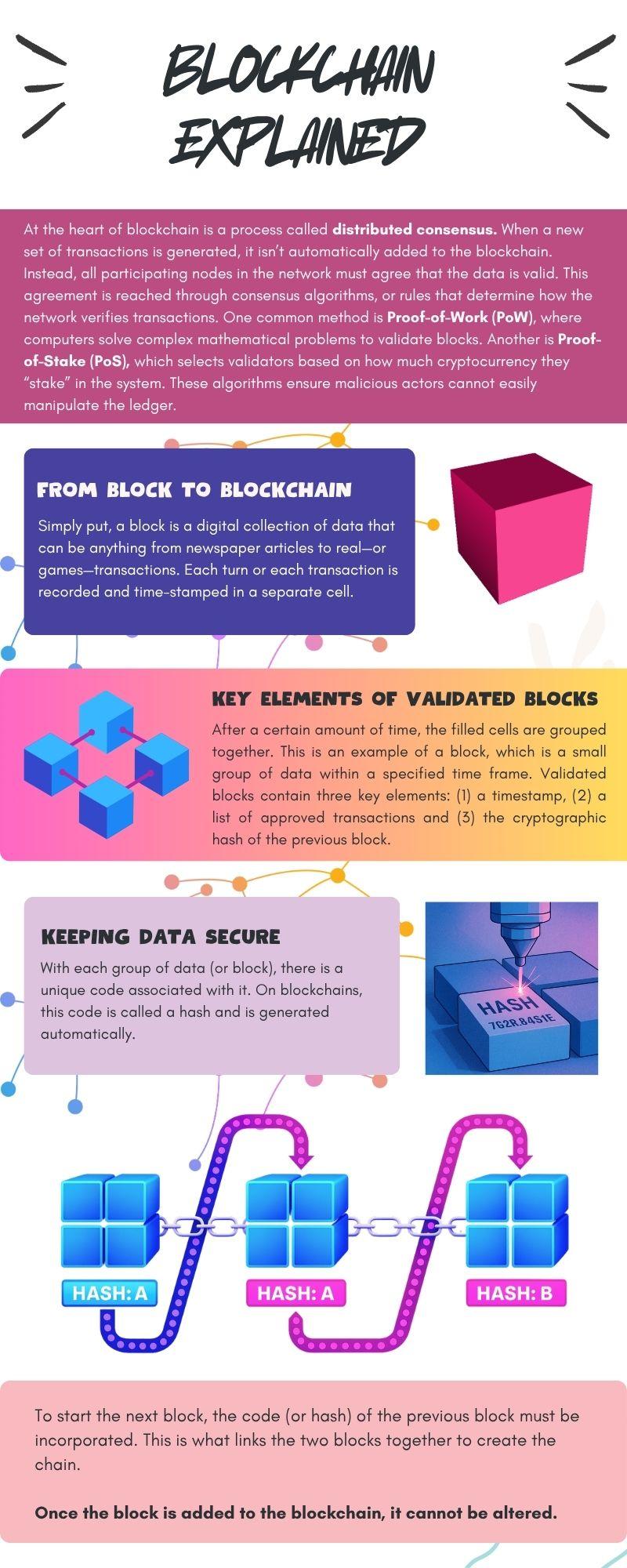

At the heart of blockchain is a process called distributed consensus. When a new set of transactions is generated, it isn’t automatically added to the blockchain. Instead, all participating nodes in the network must agree that the data is valid. This agreement is reached through consensus algorithms, or rules that determine how the network verifies transactions. One common method is Proof-of-Work (PoW), where computers solve complex mathematical problems to validate blocks. Another is Proof-of-Stake (PoS), which selects validators based on how much cryptocurrency they “stake” in the system. These algorithms ensure that malicious actors cannot easily manipulate the ledger.

Validated blocks contain three key elements: (1) a timestamp, (2) a list of approved transactions and (3) the cryptographic hash of the previous block. This hash links blocks together in chronological order and prevents tampering. If someone attempts to alter a single block, the hash changes (breaking the chain) and alerting the entire network. See how this process looks like in the infographic below.

Blockchain’s decentralised architecture also prevents single points of failure. Even if some nodes go offline or are compromised, the system remains functional and secure. This resilient network design not only safeguards data integrity but also provides a robust foundation for advanced features. Building on this, smart contracts (self-executing code stored on the blockchain) enable automated, trustworthy transactions that follow predefined rules without human intervention.

It's also important to note that there is not just one blockchain. Instead, blockchain is a technology that anyone (companies, organisations, governments, etc.) can use to build their own networks. Blockchains can be public (permissionless), where anyone can participate and view the ledger, or private (permissioned), where access is restricted to approved participants only.

These features make blockchain suitable for a wide spectrum of sectors. It can be used to timestamp and verify intellectual property rights, automate compliance reporting or create permanent academic credentials. By combining consensus, cryptography, and decentralisation, blockchain enables new forms of cooperation across sectors that traditionally depend on intermediaries. In the next chapter, we look at the way blockchain is bringing about a new-age evolution in the world of finance, banking, and government processes.

Blockchain's impact on the world

Transforming financial markets

Blockchain is transforming financial markets by enabling faster, cheaper, and more transparent transactions. By recording trades on a decentralised ledger, blockchain reduces the need for intermediaries such as clearinghouses and custodians, streamlining processes and lowering costs. This technology supports direct value transfers and real-time settlement, which can significantly improve efficiency in areas like securities trading and asset tokenisation. As a result, market participants benefit from reduced operational risks, enhanced transparency, and greater accessibility to financial products.

This way, blockchain has paved the way for decentralised finance (DeFi), a set of financial services (such as lending, borrowing or trading) built on public blockchains. DeFi platforms operate without central authorities, using smart contracts to automate transactions and enforce rules. While DeFi remains a niche market, with EBA, the European Banking Authority and ESMA, the European Securities and Markets Authority, noting it represents about 4% of global crypto-asset value, its innovation potential is significant. The EU is actively fostering blockchain innovation through regulatory frameworks like the Markets in Crypto-Assets Regulation (MiCA) and the DLT Pilot Regime, which support experimentation with tokenised financial instruments and ensure investor protection (see the EU’s blockchain strategy and a 2021 report by Finance Watch on the EU’s digital strategy package). Initiatives such as the EBSI further illustrate the EU’s commitment to secure, efficient digital finance. The Health and Digital Executive Agency (HaDEA) notes that over 127 million EUR was awarded in 2024 under the Digital Europe Programme of the European Union for the rollout of EBSI services, the development of standards, and piloting digital identity solutions. The 2022 Digital Markets Act (DMA) aims to ensure fair competition and interoperability in digital markets, thus creating opportunities for blockchain-based platforms to compete with established digital gatekeepers. The Digital Services Act (DSA) contributes to building a safer and more trustworthy digital finance ecosystem through improved algorithm transparency in fintech and crypto platforms and a clear framework for platform responsibility resulting in boosted overall trust.

Real-world examples include tokenised securities (real assets turned into a digital token on a blockchain) and instant settlement platforms (where trades happen immediately and in real-time, without the need to wait for approval) which are being piloted across Europe. These advances promise to make markets more accessible, reduce operational risks, and encourage new business models. While challenges remain (such as regulatory harmonisation and cybersecurity), the EU’s proactive approach aims to harness blockchain’s benefits while safeguarding financial stability.

Revolutionising banking

Blockchain’s impact on banking is profound, with the technology poised to reshape core processes and services across the sector. One of the most significant changes is in cross-border payments. Traditionally, such transactions are slow and expensive due to multiple intermediaries and complex reconciliation processes. Blockchain streamlines this by enabling direct, peer-to-peer transfers on a decentralised ledger, reducing settlement times from days to minutes and substantially lowering transaction costs. The European Commission has recognised this potential, highlighting blockchain’s role in making cross-border payments more efficient and transparent within the EU’s Digital Finance Strategy. The basic concepts of the strategy are visualised in the figure below.

Security is another major area of improvement. With its cryptographic foundations and distributed architecture, blockchain significantly reduces the risk of fraud, data tampering, and single points of failure. Each transaction is transparently recorded and time-stamped, making unauthorised changes nearly impossible without alerting the entire network. The EU’s EBSI (European Blockchain Services Infrastructure) - a live, EU-wide blockchain network for trusted government and business services, exemplifies these security benefits, using blockchain to safeguard sensitive financial and identity data.

Smart contracts (those self-executing agreements coded directly onto the blockchain) further enhance banking operations. They automate processes such as loan disbursements, compliance checks, and trade settlements, ensuring transactions are executed exactly as programmed without manual intervention. This automation not only reduces operational costs but also minimises errors and increases trust between parties.

However, these benefits come with challenges. Regulatory uncertainty remains a major hurdle, as existing legal frameworks were not designed for decentralised systems. The EU has responded with initiatives like the already mentioned MiCA and DLT Pilot Regime, aiming to provide legal clarity and foster innovation while protecting consumers and financial stability.

Government processes and beyond

Building on its inherent transparency and immutability, blockchain offers significant improvements for government processes, fostering greater efficiency and public trust (Alessie et al, 2019). By providing a decentralised, tamper-evident ledger, blockchain can make government processes more transparent and accountable.

For example, research by the European Commission and academia has highlighted blockchain’s capacity to increase trust and transparency in government institutions by enabling open, auditable records of public spending (Batubara et al, 2024), procurement, and political party financing (Mooij, 2024). Studies like those coming from the EU Blockchain Observatory & Forum (EUBOF) and the European Commission’s Joint Research Centre emphasise that blockchain’s transparency mechanisms can help enforce compliance and reduce corruption risks.

Securing voting systems is another promising application. Blockchain can underpin digital voting platforms where every vote is recorded immutably and transparently, reducing the risk of manipulation and enabling end-to-end verifiability for citizens and auditors. The European Commission has identified digital voting as a key use case in its blockchain policy agenda, noting ongoing pilot projects across Member States (Bruter, et al., 2023). These pilots aim to enhance both accessibility and trust, while maintaining privacy and data protection in line with EU standards.

For public records (such as land registries, civil status or academic credentials) blockchain can also streamline processes, cut administrative costs and eliminate data silos. The “Once Only Principle” promoted in the EU eGovernment Action Plan is supported by blockchain’s ability to securely share verified data across agencies, so citizens only need to provide information once. Pilot projects in Europe have demonstrated blockchain’s effectiveness in creating secure, accessible, and tamper-proof land registries (for further reading, see the blockchain-based land registry database and this explanatory report), and diploma sharing platforms.

Despite these benefits, challenges remain, including legal and organisational compatibility, scalability, and the need for common standards. Nevertheless, the European Union continues to invest in research, pilot deployments, and regulatory frameworks to unlock blockchain’s full potential for efficient, trustworthy digital government.

The road ahead: challenges & opportunities

Blockchain holds significant promise for transforming digital services, finance, and public administration across the European Union. Its potential lies in providing secure, transparent, and tamper-proof systems that reduce reliance on intermediaries and foster trust in digital transactions. The technology is already enabling innovative applications in supply chain tracking, digital identity, and decentralised finance, among many others, with the EU actively supporting pilot projects and infrastructures such as the EBSI.

However, despite these advances, blockchain faces critical challenges, some of them related to scalability and energy consumption. Many early blockchain networks, notably those using Proof-of-Work consensus, have struggled with limited transaction throughput and high energy use. A 2021 EUBOF report highlights that energy efficiency and scalability must be addressed together, recommending that future blockchain solutions balance performance with sustainability goals. The EU’s strategy emphasises the adoption of greener consensus mechanisms and the integration of renewable energy sources to mitigate the environmental impact of blockchain deployments.

Regulatory clarity is another key concern. The EU has taken a proactive stance, introducing the MiCA or the DLT Pilot Regime to provide legal certainty, protect consumers, and foster innovation in blockchain-based financial services. The European Blockchain Sandbox, launched in 2023, further encourages experimentation by allowing innovators and regulators to collaborate in a controlled environment, reducing legal fragmentation.

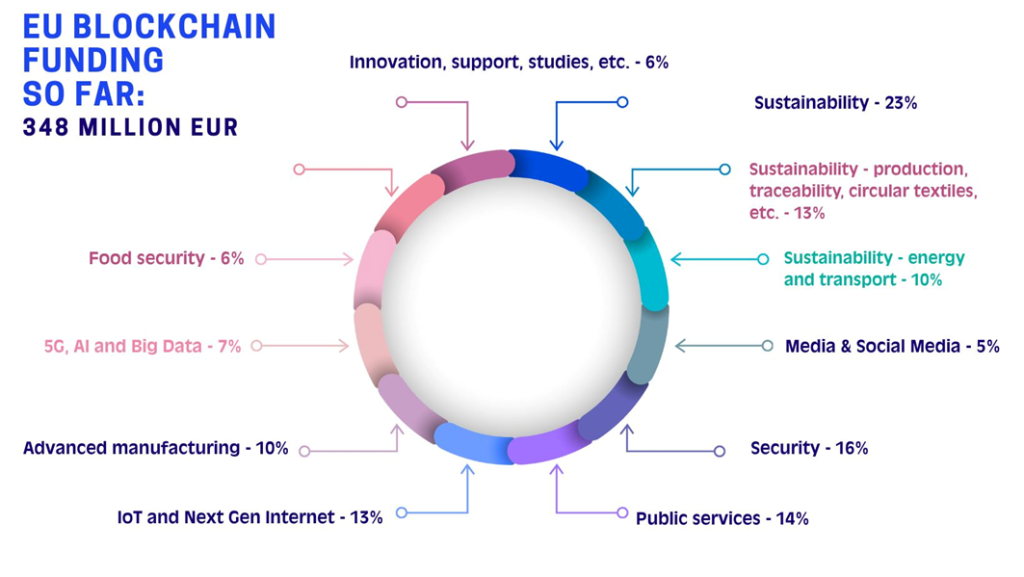

The New EU Innovation Agenda prioritises support for emerging technologies, including blockchain, through funding, research, and regulatory sandboxes to accelerate digital transformation. This comprehensive approach (combining investment, policy, and technical guidance) positions the EU as a leader in responsible blockchain adoption. While challenges around scalability, energy, and regulation remain, ongoing research and policy initiatives suggest a realistic yet optimistic future where blockchain can play a foundational role in Europe’s digital and green transitions (see Figure 3 – Elements of the EU Blockchain strategy).

So, while blockchain is not a cure-all, its capacity to build trust without central authorities, streamline operations, and enable new business models suggests it will play a growing role in the digital infrastructure of Europe and beyond. As technical and regulatory hurdles are addressed, its real-world impact is likely to expand steadily and responsibly.