State of European Tech 2025: what hot topics emerge for Luxembourg?

Atomico recently published the 2025 edition of its annual State of European Tech report: an in-depth analysis of the European tech ecosystem. Below are some highlights from the report, and an analysis of the lessons that Luxembourg can extract from it in its efforts to lead on the European digital transformation. We also look at the hot topics for Luxembourg based on insights from the report.

Taking stock of the EU tech ecosystem today: huge leap in growth overshadowed by growing talent shortage

Bolstered investment in tech has led to growth on EU-wide scale

Growth in the EU tech sector has surpassed expectations, with the tech ecosystem jumping in value (from less than $1T a decade ago to around $4T in 2026). Today, Europe's tech ecosystem represents 15% of the bloc's GDP. In 2016, a decade ago, this figure stood at just over 4%).

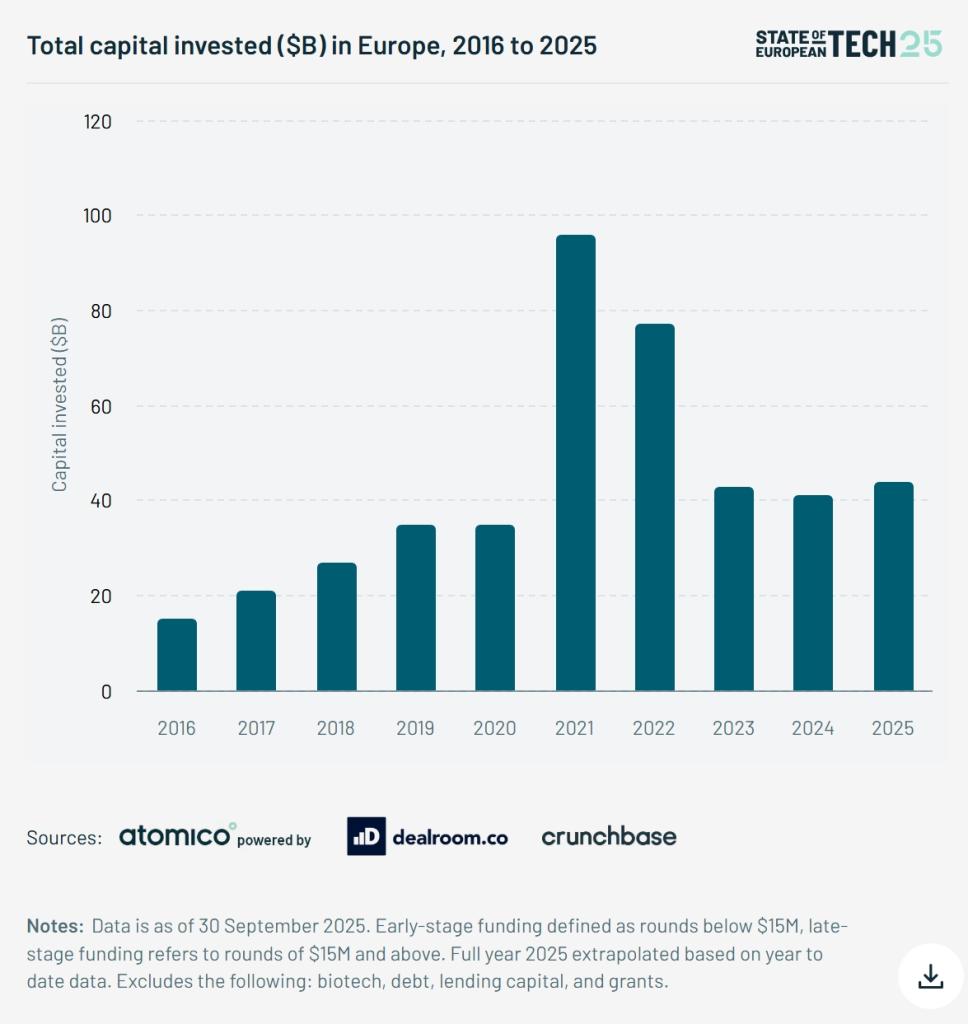

Investment is also rising, although nowhere near its largest bump back in 2021, as the graph below illustrates. According to the report, current data shows investment in tech start-ups is on track to finish at around $44B, showing a marked increase since 2024.

Deep tech is also fuelling investment rates upwards. In 2025, 36% of European venture capital (VC) dollars went into deep tech companies. In 2021, this figure was just 19%. At the same time, the EU still lags behind its counterparts on a global scale both in terms of deep-tech investment size, but also concentration.

Empowering digital talent - key to addressing persisting EU-wide gaps

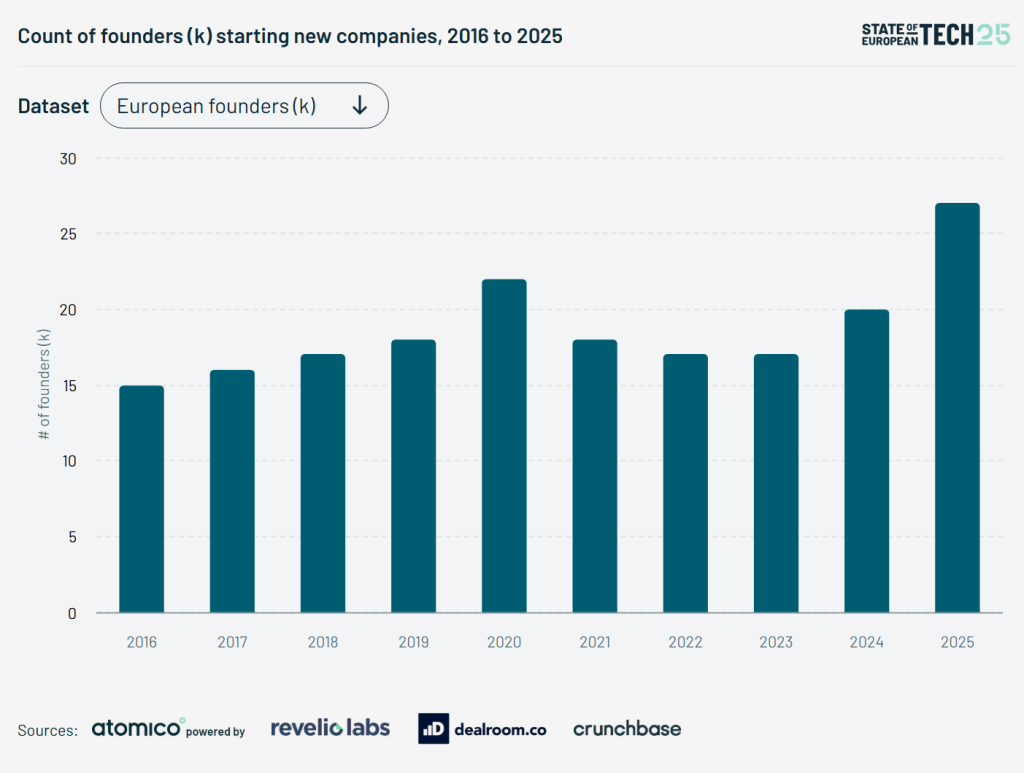

Entrepreneurship is on the rise globally, and especially in Europe, against the backdrop of an increasingly faster race for innovation. In 2025, almost 60% more people in Europe started companies compared to 2023, representing the highest number of enterprise founders starting new ventures than any other year. Lowered barriers for starting entrepreneurs and businesses (from no-code tools to stronger founders networks) have opened the door for many with ideas, across all age groups and countries in Europe.

Key lessons the report's challenges to take stock of (a Luxembourgish perspective)

Luxembourg performs strongly in the EU-27 across several indicators, and its tech ecosystem has been growing steadily over the past decade. Investment in deep tech in Luxembourg seen significant long-term venture activity, with over $1.9 billion in total funding invested in deep tech start-ups in Luxembourg for the period 2016 to 2026.

In 2025, 60.1% of Luxembourg’s adult population had at least basic digital skills, a level above the EU average but still below the Digital Decade 2030 target of 80%. Luxembourg continues to have a high concentration of ICT specialists, with 8.0% of total employment classified as ICT specialist roles, making it one of the highest shares in the EU. The EU average share of ICT specialists is near 5%, underscoring Luxembourg’s comparatively strong position in digital specialist employment.

Here are the key lessons for Luxembourg that can be extracted - and some of the challenges the State of European Tech 2025 report lays bare.

A growing sense of urgency to reduce EU-wide fragmentation of the tech ecosystem

While more people in Europe are opening up companies, lack of trust undermines positive scoring: 70% of founders consider the European environment too restrictive for a starting tech company to grow and thrive in. Amongst the largest obstacles are market fragmentation, difficulties in accessing finance, and overly complicated and cumbersome tax system (in some EU Member States more than others). Initiatives such as EU-INC and the future 28th Regime for Innovative Companies aim to facilitate cross-border operation and accelerate business creation.

The “growth gap”: lack of late-stage capital despite stable investment

As seen earlier in this article, venture capital investments remain stable, but large-scale fundraising is lacking. European pension funds invest very little in tech compared to the US - and catching up would add hundreds of billions to the European ecosystem. Another danger is the magnitude of foreign investment in Europe - an aspect that can push start-ups out of the continent.

The "talent gap": attracting and retaining senior, high-level profiles

Europe has a strong tech workforce, but is struggling to retain experienced talent. More and more founders are choosing to set up their business in the United States for a variety of reasons - from accessing capital and customers more easily, to benefitting from more flexible regulation.

Deep tech and growing sovereignty

Deep tech now accounts for 36% of VC investments and sovereignty technologies (AI, defence, energy) are growing strongly. Europe is also proving its ability to create competitive AI players such as Mistral or Lovable.